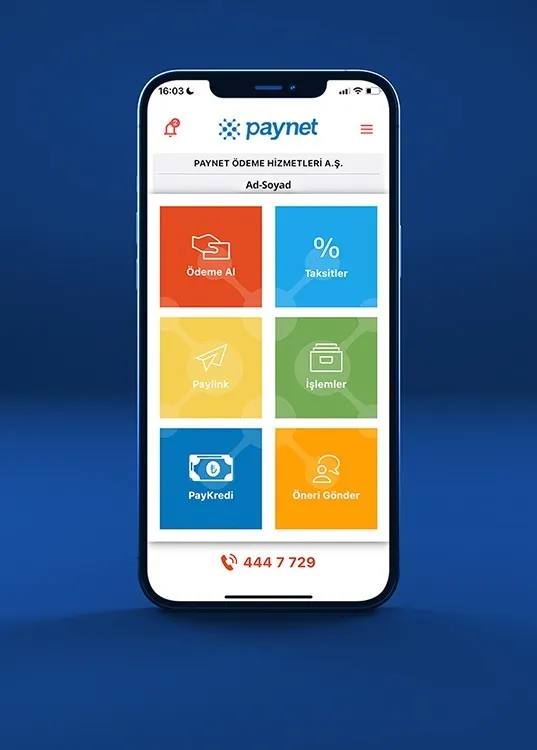

Manage Your Cash Flow from Your Smart phone by using Paynet MobilePOS

Paynet is a payment app that enables mmber merchants to collect payments faster and easier, independent of location.

All Paynet member merchants log in via Paynet MobilePOS with their unique user name, dealer code, and password. It includes many alternative payment methods such as payment by link, payment by loan, payment by card and contactless payment by NFC. In addition, member merchants can access all features such as reporting and tracking financial transactions on this app. To use the Paynet Mobile POS application, it is sufficient to log in with your existing Paynet merchant information. No additional fees are charged.

To Download Our Mobile App:

You can learn more about the application by watching the following 1 minute and 25 second Cep POS video.

Conveniences offered by the Paynet MobilePOS

- Compatible with all smart phones and tablets

- You can manage all financial processes from a single screen

- Receive payments easily in the field

- Eliminates costs associated with purchasing POS devices and receipts

- Greater efficiency with fast collections

- Easy access to all payment methods

- Instant access to reports

- Diversifies payment methods

For detailed information about all our products and solutions, you can contact us by calling our call centre number (0216) 599 01 00 or by sending an e-mail to @email

What are the Benefits of the Paynet MobilePOS ?

What is the Paynet MobilePOS?

The Paynet MobilePOS is a payment app that enables Paynet member merchants to receive payments faster and easier.

What Services Does the Paynet MobilePOS Offer?

- Receive payment with card details

- Receive payment by link

- Receive payments with NFC

- Receive payments with loan

- View transaction details

What is mobile payment?

Mobile payment refers to payment transactions made using a mobile device.

How to enable mobile payment?

- Choose a service provider.

- Create an account.

- Integrate API.

- Identify products/services.

- Offer payment options.

- Take security measures.

- Test and certify.

- Go live.

- Educate users.

- Monitor and maintain.

How to make a mobile payment?

- Select an appropriate payment method.

- Select what you want to purchase.

- Enter the required information.

- Confirm the transaction.

- Perform additional verification if necessary.

In which category is mobile payment shopping most common?

Mobile payment shopping is most common in the e-commerce and digital content categories. In particular, e-commerce sites that sell products and services such as clothing, electronics, groceries, travel, and entertainment often use mobile payment methods.